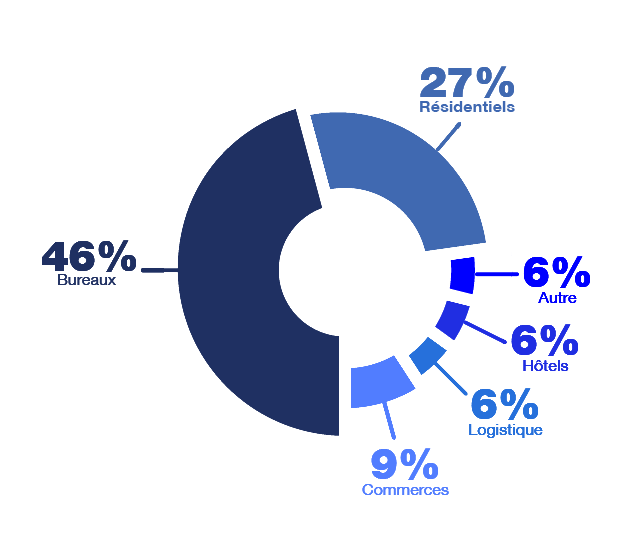

CDC Investissement Immobilier’s portfolio consists of approximately 150 asset lines lines representing a value at the end of 2020 of €9.2 bn, diversified across several sectors: offices, residential to rent, retail, logistics and hospitality.

Arnaud Taverne, Chief Executive Officer

Interview "Quelles sont les caractéristiques du portefeuille d'investissement ?"

CDC Investissement Immobilier en quelques chiffres

€10,7bn

Assets Under Management

€6,1bn

Transaction volumes since 2015

€2,9bn

Developments launched

CDC Investissement Immobilier has implemented an international investment strategy

This strategy aims at both diversifying the portfolio’s exposure, which has historically been overweighted to France, and broadening its investment territory to optimize the selection effect.

The international strategy replicates the strategy deployed in France, both in terms of sectors and risk profiles, in the main European markets (London, Big 7 Germany and other Western European capitals), through partnerships with local players

Some examples of CDC Investissement Immobilier’s real estate portfolio

St John's Lane, Emergence, Harmony, Rhapsody, Le Théâtre des Champs-Elysées, Le Marquis, Myslbek, Adenauer, Chateaudun, Enjoy, Evidence, Franklin, La Maréchalerie, Lafayette, Neuilly Potin, Caserne de Reuilly, 85 rue Petit

METAL 57

Club deal

Bureaux

Boulogne-Billancourt

37 113 m²

Stratégie Core

85 RUE PETIT

100% CDC

Résidentiel

Paris 19ème

75 lots (5 035 m²)

Stratégie Core

Also to be read